Guide to prediction markets, probability economics, and onchain edge

Prediction markets are not about guessing the future.

They are about pricing uncertainty better than others.

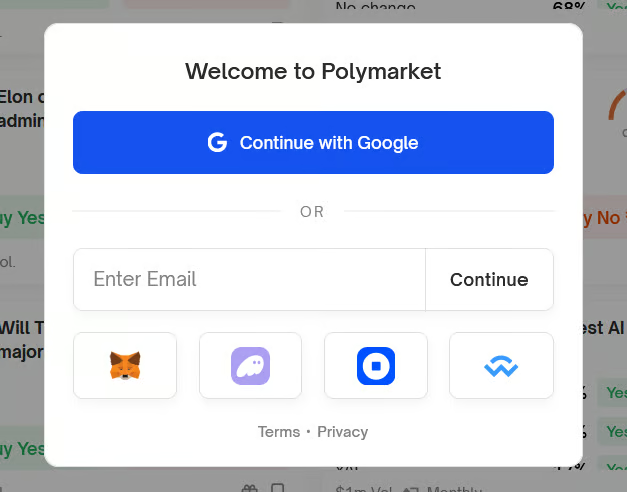

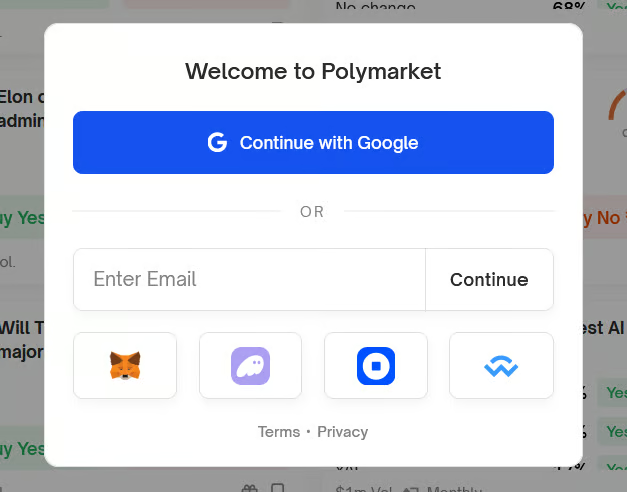

Polymarket is frequently misunderstood. To newcomers, it looks like a crypto betting site. To experienced researchers and traders, it is something far more powerful: a decentralized exchange for probabilities.

Instead of trading stocks, bonds, or tokens, Polymarket allows participants to trade beliefs about real-world outcomes like elections, crypto milestones, macro events, sports, and cultural trends. And where beliefs are mispriced, profit emerges.

This article explains how money is actually made on Polymarket, why it works, and how it compares to competing prediction platforms.

Every Polymarket market asks a binary question:

Will this event happen? YES or NO

Each outcome is represented by a contract priced between $0 and $1.

YES at $0.72 → market implies a 72% chance

NO at $0.28 → market implies a 28% chance

At settlement:

The correct outcome pays $1.00

The incorrect outcome pays $0.00

This structure turns probability itself into a tradable financial asset.

In traditional betting, odds are imposed by a house.

In prediction markets, prices emerge organically from participants.This means profits flow to information, not to intermediaries.

This is the most intuitive strategy.

You:

Identify a market where probability is mispriced

Buy YES or NO

Hold until resolution

Redeem winning contracts for $1.00

Example

Market: “Will Ethereum approve spot ETFs this year?”

Market price: YES at $0.42

Your assessment: ~70% likelihood based on regulatory signals

If YES resolves:

Cost: $0.42

Payout: $1.00

Profit: $0.58 per share

This strategy rewards deep research and patience, but capital remains locked until resolution.

This is where most professional traders operate.

You don’t need to wait for the final outcome.

You only need to anticipate how beliefs will change.

Prices move due to:

Breaking news

Narrative shifts

Influential traders entering positions

Liquidity changes

Example

YES at $0.50

New information emerges

Price moves to $0.72

You sell → 44% return without waiting for settlement

This is probability arbitrage, not prediction perfection.

You can lose a prediction and still make money

if you correctly anticipate how the market will react.

In less liquid markets, experienced participants:

Place limit orders on both YES and NO

Capture spread as prices fluctuate

Provide liquidity when others hesitate

While Polymarket doesn’t yet expose full market-making APIs to retail traders, disciplined manual execution can approximate this strategy.

This approach prioritizes:

Risk control

Order discipline

Microstructure awareness

Polymarket runs on Polygon, using a hybrid architecture:

Off-chain order matching (CLOB) for speed

On-chain settlement for trust minimization

USDC settlement for price stability

Gas sponsorship removes friction for active traders

There are:

No trading fees

No native token dilution

No forced exposure to volatility beyond your position

This makes Polymarket structurally closer to a financial exchange than a betting platform.

The most profitable Polymarket traders are rarely the loudest.

They are the earliest or the most context-aware.

Edges often come from:

Primary-source research

Legal and procedural knowledge

Domain expertise (crypto governance, elections, sports rules)

Being online when news breaks

Small wording details decide profits:

Who verifies the outcome?

What exact conditions trigger YES?

What happens in edge cases?

Misreading resolution criteria is one of the biggest sources of retail losses.

Being “right in spirit” but wrong in wording

still means losing money.

Polymarket feels like gambling but profitable traders behave like risk managers.

Key principles:

Never over-allocate to a single market

Size positions relative to confidence

Diversify across unrelated events

Respect opportunity cost of locked capital

A consistent 55% edge compounds better than reckless conviction.

Centralized

U.S.-regulated

Strict limits on position sizes

Fewer markets

Tradeoff:

PredictIt offers legality and simplicity, but structural constraints limit profit potential.

Fully decentralized

Uses REP token for disputes

Higher complexity

Historically fragmented liquidity

Tradeoff:

Augur offers ideological purity. Polymarket offers execution efficiency.

U.S.-regulated exchange

Dollar-based

Full KYC/AML

Focus on traditional macro and weather markets

Tradeoff:

Kalshi offers legal clarity. Polymarket offers permissionless access and crypto-native flexibility.

No fees → small edges remain profitable

Stablecoin settlement → no hidden volatility

Non-custodial → minimized counterparty risk

Open global access (jurisdiction permitting)

This combination is rare and powerful.

Best suited for:

Researchers and analysts

Crypto-native traders

Journalists with early access to information

Event-driven strategists

Poor fit for:

Emotional gamblers

Users chasing adrenaline

Traders unwilling to read market rules

Polymarket operationalizes a long-standing insight from economics:

Markets aggregate information more efficiently than experts or polls.

Making money on Polymarket is not about predicting the future perfectly.

It is about pricing uncertainty better or earlier than the crowd.

Over time, those marginal advantages compound.

And that is how real profit is made.

<100 subscribers

Guide to prediction markets, probability economics, and onchain edge

Prediction markets are not about guessing the future.

They are about pricing uncertainty better than others.

Polymarket is frequently misunderstood. To newcomers, it looks like a crypto betting site. To experienced researchers and traders, it is something far more powerful: a decentralized exchange for probabilities.

Instead of trading stocks, bonds, or tokens, Polymarket allows participants to trade beliefs about real-world outcomes like elections, crypto milestones, macro events, sports, and cultural trends. And where beliefs are mispriced, profit emerges.

This article explains how money is actually made on Polymarket, why it works, and how it compares to competing prediction platforms.

Every Polymarket market asks a binary question:

Will this event happen? YES or NO

Each outcome is represented by a contract priced between $0 and $1.

YES at $0.72 → market implies a 72% chance

NO at $0.28 → market implies a 28% chance

At settlement:

The correct outcome pays $1.00

The incorrect outcome pays $0.00

This structure turns probability itself into a tradable financial asset.

In traditional betting, odds are imposed by a house.

In prediction markets, prices emerge organically from participants.This means profits flow to information, not to intermediaries.

This is the most intuitive strategy.

You:

Identify a market where probability is mispriced

Buy YES or NO

Hold until resolution

Redeem winning contracts for $1.00

Example

Market: “Will Ethereum approve spot ETFs this year?”

Market price: YES at $0.42

Your assessment: ~70% likelihood based on regulatory signals

If YES resolves:

Cost: $0.42

Payout: $1.00

Profit: $0.58 per share

This strategy rewards deep research and patience, but capital remains locked until resolution.

This is where most professional traders operate.

You don’t need to wait for the final outcome.

You only need to anticipate how beliefs will change.

Prices move due to:

Breaking news

Narrative shifts

Influential traders entering positions

Liquidity changes

Example

YES at $0.50

New information emerges

Price moves to $0.72

You sell → 44% return without waiting for settlement

This is probability arbitrage, not prediction perfection.

You can lose a prediction and still make money

if you correctly anticipate how the market will react.

In less liquid markets, experienced participants:

Place limit orders on both YES and NO

Capture spread as prices fluctuate

Provide liquidity when others hesitate

While Polymarket doesn’t yet expose full market-making APIs to retail traders, disciplined manual execution can approximate this strategy.

This approach prioritizes:

Risk control

Order discipline

Microstructure awareness

Polymarket runs on Polygon, using a hybrid architecture:

Off-chain order matching (CLOB) for speed

On-chain settlement for trust minimization

USDC settlement for price stability

Gas sponsorship removes friction for active traders

There are:

No trading fees

No native token dilution

No forced exposure to volatility beyond your position

This makes Polymarket structurally closer to a financial exchange than a betting platform.

The most profitable Polymarket traders are rarely the loudest.

They are the earliest or the most context-aware.

Edges often come from:

Primary-source research

Legal and procedural knowledge

Domain expertise (crypto governance, elections, sports rules)

Being online when news breaks

Small wording details decide profits:

Who verifies the outcome?

What exact conditions trigger YES?

What happens in edge cases?

Misreading resolution criteria is one of the biggest sources of retail losses.

Being “right in spirit” but wrong in wording

still means losing money.

Polymarket feels like gambling but profitable traders behave like risk managers.

Key principles:

Never over-allocate to a single market

Size positions relative to confidence

Diversify across unrelated events

Respect opportunity cost of locked capital

A consistent 55% edge compounds better than reckless conviction.

Centralized

U.S.-regulated

Strict limits on position sizes

Fewer markets

Tradeoff:

PredictIt offers legality and simplicity, but structural constraints limit profit potential.

Fully decentralized

Uses REP token for disputes

Higher complexity

Historically fragmented liquidity

Tradeoff:

Augur offers ideological purity. Polymarket offers execution efficiency.

U.S.-regulated exchange

Dollar-based

Full KYC/AML

Focus on traditional macro and weather markets

Tradeoff:

Kalshi offers legal clarity. Polymarket offers permissionless access and crypto-native flexibility.

No fees → small edges remain profitable

Stablecoin settlement → no hidden volatility

Non-custodial → minimized counterparty risk

Open global access (jurisdiction permitting)

This combination is rare and powerful.

Best suited for:

Researchers and analysts

Crypto-native traders

Journalists with early access to information

Event-driven strategists

Poor fit for:

Emotional gamblers

Users chasing adrenaline

Traders unwilling to read market rules

Polymarket operationalizes a long-standing insight from economics:

Markets aggregate information more efficiently than experts or polls.

Making money on Polymarket is not about predicting the future perfectly.

It is about pricing uncertainty better or earlier than the crowd.

Over time, those marginal advantages compound.

And that is how real profit is made.

Share Dialog

Share Dialog

No comments yet